Bernanke

described economics as, “a highly sophisticated field of thought that is superb

at explaining to policymakers precisely why the choices they made in the past

were wrong. About the future, not so much” (2013). To

further contemplate on this view, in the first blog, I shall briefly

describe the subprime mortgage market concepts, history, risks and the crisis.

The

subprime mortgages, also called non-traditional mortgages (NTMs) are the loans that

are offered to borrowers that have higher credit-risk characteristics (Utt,

2008, p. 2; Gorton, 2008, p.7)

Figure

1, describes the relationships of all the key players involved in subprime mortgage

loan crisis. Banks or mortgage lending institutions (lenders) through a

mortgage broker (originator) would make the loans to the borrowers (homeowners)

and after servicing the loans for a year or less, sell them off to big Wall

Street investment banks. The investment

banks in turn securitized, with appropriate credit ratings assigned from the

credit agencies, packaged them into various financial products, such as; mortgage

backed securities (MBS), collateralized debt obligations (CDOs), collateralized

mortgage obligations (CMOs), and credit default swaps (CDS) etc. and then sold

them to investors (Demyanyk & Hemert, 2011; Gilbert, 2011; Lewis, 2010;

Muolo & Padilla, 2008). According to Congressional research service report

in 2005, $507 billion in subprime mortgage loans were pooled and sold as

mortgage backed securities (MBS) to private investors, as compared with only

$18.5 billion in 1995, (Getter, Jickling, Labonte & Murphy, 2007, p.

CRS-3).

|

| Figure 1: Key Players, Key Influencers, and Governing Agencies involved in Subprime Mortgage Crisis (Depicted by Author) |

The

Financial Crisis Inquiry Commission (FCIC) was set up by the US Congress (US Congress,

2009) to examine the cause of the economic and financial crisis in the United

States. Table 1, shows the breakdown of NTMs held by Government-supported

enterprises (GSEs) and the private investment banks (Angelides, et al., 2011,

p. 456, Table 1).

Table 1: Government-sponsored enterprises (GSEs) and the Investment banks holdings of NTMs (Subprime and Alt-A Loans)

According

to the annual report of the council of economic advisors (Lazear, 2008, p.291,

Table B-56), presented by President Bush, record levels of 1.283 million homes

were sold in 2005. The housing prices appreciated rapidly from 2001, reaching

13% in 2006 (Getter, et al. 2007, p. CRS-1), as shown in Figure 2 (Angelides et

al., 2011, p. 457), and then the housing bubble burst.

What

went wrong? Subprime borrowers are riskier than prime borrowers (Gorton, 2008,

p.6). A whopping $7 trillion in home equity was lost (Bernanke, 2012, p. 3).

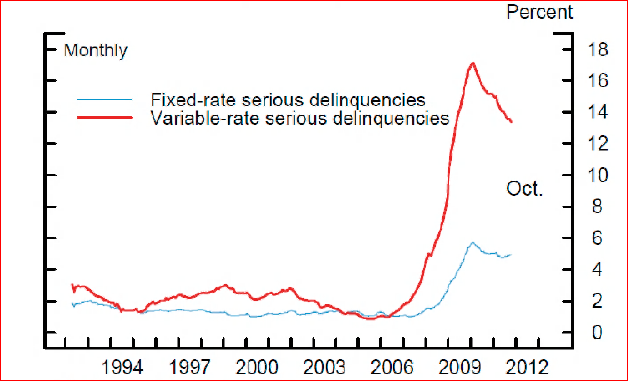

As

shown in Figure 3, there were 12 million homeowners that had a negative home

equity in their homes (Bernanke, 2012, p.4) and the delinquency rates were

rising as shown in Figure 4 (Bernanke, 2012,

p. 6).

Reference

Angelides, P., Thomas, B.

Hon., Born, B., Georgiou, B., Graham, B., Senator, Hennessey, K. &

...Wallison, P. J. (2011). The Financial Crisis Inquiry Report. Retrieved July

6, 2013, from http://cybercemetery.unt.edu/archive/fcic/20110310173545/http://c0182732.cdn1.cloudfiles.rackspacecloud.com/fcic_final_report_full.pdf

Bernanke, B. (2012).

Housing-White-Paper-20120104. Retrieved July 2, 2013, from

http://www.federalreserve.gov/publications/other-reports/files/housing-white-paper-20120104.pdf

Bernanke, B. S. (2013). At

the Baccalaureate Ceremony at Princeton University, Princeton, New Jersey.

Retrieved July 4, 2013, from

http://www.federalreserve.gov/newsevents/speech/bernanke20130602a.htm

Demyanyk, Y., & Van

Hemert, O. (2011). Understanding the Subprime Mortgage Crisis. Review of

Financial Studies, 24(6), 1848-1880. Retrieved from

http://search.ebscohost.com.proxy1.ncu.edu/login.aspx?direct=true&db=bth&AN=61047576&site=eds-live

Getter, D., Jickling, M.,

Labonte, M., & Murphy, E. (2007). CRS Report for Congress: Financial

Crisis? The Liquidity Crunch of August 2007. Retrieved July 5, 2013, from

http://assets.opencrs.com/rpts/RL34182_20070921.pdf

Gilbert, J. (2011). Moral

Duties in Business and their Societal Impacts: The Case of the Subprime Lending

Mess. Business & Society Review (00453609), 116(1), 87-107.

doi:10.1111/j.1467-8594.2011.00378.x

Gorton, G. B. (2008). The Panic of 2007. Retrieved July 4, 2013, from http://nber.org/papers/w14358.pdf

Lewis, M. (2010). The Big

Short: Inside the Doomsday Machine. New York: W. W. Norton.

Muolo, P., & Padilla, M.

(2008). Chain of Blame [electronic resource] : How Wall Street Caused the

Mortgage and Credit Crisis / Paul Muolo, Mathew Padilla Hoboken, N.J. :

John Wiley & Sons, c2008. Retrieved from

http://search.ebscohost.com.proxy1.ncu.edu/login.aspx?direct=true&db=cat01034a&AN=nu.10249111&site=eds-live;

http://site.ebrary.com.proxy1.ncu.edu/lib/ncent/Doc?id=10249111

US Congress. (2009). Fraud

Enforcement and Recovery Act of 2009 or FERA. Retrieved July 7, 2013, from

http://www.gpo.gov/fdsys/pkg/PLAW-111publ21/pdf/PLAW-111publ21.pdf

Utt, R. (2008). The Subprime

Mortgage Market Collapse: A Primer on the Causes and Possible Solutions.

Retrieved July 2, 2013, from http://www.heritage.org/research/reports/2008/04/the-subprime-mortgage-market-collapse-a-primer-on-the-causes-and-possible-solutions?ac=1

Having your own house is the dream of every person. For a middle class person, it is considered as a lifetime achievement as it requires quite a huge amount of money. Banks play a pivotal role in fulfilling this basic need. The products they offer and the services they provide are of immense use to people who intend to have their own house. For a safe and beneficial home loan, proper awareness over the products, policies, terms and conditions of the bank is most important as ignorance may result in more payments to the bank in terms of principal and interest components.

ReplyDeleteBut working with Mr Pedro changed everything in the lending experience, Mr Pedro helped me with a home loan at 2% rate which was very fast and smooth.

I will recommend Mr Pedro a loan officer and his awesome funding company Email Mr Pedro on pedroloanss@gmail.com.

Marie Carlos,

Texas USA